This is the final in a series of four Deetken “Reflections” exploring the intersections between macroeconomic policy and fragility in countries affected by violent conflict. The first post reflected on the key messages emerging from a review of over 100 sources and 10 expert interviews. The second explored the impact of natural resource revenue management on fragility in conflict-affected contexts, while the third considered the relationship between tax policy and fragility in conflict-affected contexts. This “Reflections” summarizes the evidence around the impact of monetary and exchange rate policy on fragility in conflict-affected contexts. We conclude with a number of evidence gaps and research questions that could form part of a future research agenda. This series builds on work that Deetken undertook on behalf of The World Bank and the United Nations.

There is extensive empirical literature considering the relationship between monetary policy and key policy variables, namely inflation, output, and growth. Investigations in the context of conflict-affected countries are less common, but the last decade has seen the start of exploration in this area. Through a review of the literature and expert interviews, we explored this relationship with a view to identifying policy-relevant findings that could help guide monetary and exchange rate policies in countries affected by conflict.

Specifically, we explored three policy areas:

i) inflation and the nominal anchor;

ii) aid, seigniorage and supporting money demand; and

iii) the exchange rate regime.

Here are four main findings emerging from our review of the evidence and our discussions with experts.

Finding 1: While there is limited empirical research, there appears to be a general consensus in the literature that policies affecting inflation, money demand, and the exchange rate have important implications for fragility in conflict-affected contexts.

Inflation, money demand, and the exchange rate are three important macroeconomic variables affected by monetary and exchange rate policy which can play a role in the relative fragility of conflict-affected contexts. Inflation is often higher post-conflict (e.g. due to the monetization of fiscal deficits generated through higher military spending) and reigning in elevated inflation, particularly in post-conflict environments, is a standard policy recommendation.

The consequences of inflation in conflict-affected settings include capital flight, and the reduction in money demand which constrains seigniorage revenue for government. Some researchers have argued that declining inflation is associated with “building resilience” by pointing to the “marked decline in inflation” among countries that have built resilience from above 20% inflation in the early 1990s to the single digits more recently.[1] Money demand often deteriorates in conflict-affected contexts, with implications for seigniorage, which tends to be a more important source of revenues for governments in low-income countries. In addition, excess exchange rate volatility or an exchange rate overvaluation in conflict-affected contexts can hurt the competitiveness of exports and therefore economic growth.

The relative preponderance of supply-side shocks (e.g. terms of trade shocks whereby the price of export goods declines relative to the price of import goods or agriculture output shocks) is an important consideration for monetary policymakers in many conflict-affected countries because, unlike with demand-side shocks, policy responses involve a tension between output and price stability objectives. Furthermore, monetary and exchange rate policies for the reduction of fragility will have to be carefully coordinated with fiscal policy and with each other in a context-specific comprehensive policy approach.

Finding 2: Monetary policy in conflict-affected contexts will often be subject to unique financial and institutional constraints that may increase the relative appeal of the exchange rate as the nominal anchor and increase tolerance for inflation, as long as the policy stance promotes stability and minimizes volatility.

There is debate about the appropriate balance between the inflation and output goals of monetary policy, the appropriate measure of inflation (e.g. headline versus core inflation), and the ideal rate of inflation, particularly in contexts where there is a greater incidence of supply-side shocks. The literature is not definitive in terms of general conclusions for conflict-affected contexts. Decisions are likely to be context-specific.

The question of the optimal inflation rate from the standpoint of conflict prevention has not been studied directly. This may be partly because the question may be less relevant in fragile contexts where the objective may be to promote and maintain macroeconomic stability and focus on avoiding sudden escalations in the inflation rate. However, evidence for LICs suggests that the optimal inflation rate is likely higher for LICs compared to advanced economies because larger relative price movements are needed for efficient resource allocation in economies characterized by higher growth rates. This finding is likely applicable in conflict-affected contexts where higher inflation (e.g. 15 to 20%) may be tolerable, provided it is stable. The question may be less, “is the inflation rate optimal?”, and more “is inflation contributing to instability?”

Given the frequency of supply-side shocks in LICs (including relevant conflict-affected countries), a possible monetary policy approach is to refrain from reacting to supply-side shocks (which may be transitory and based on imported sources) by targeting core inflation, which removes food and fuel prices from the consumer price basket. This is the approach taken by, for example, the Bank of Uganda. Another perspective is that targeting core inflation may not be appropriate in LICs where food prices represent a much higher share of the consumption basket (e.g. more than 50% in the Democratic Republic of Congo) and food price inflation is more persistent.

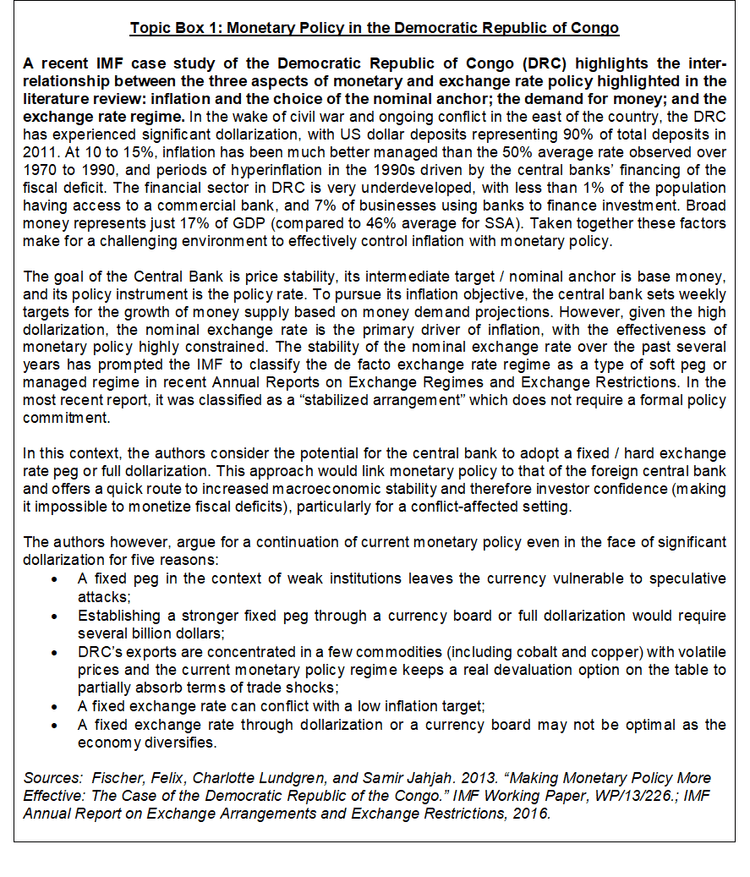

There are three standard options for the nominal anchor: target the price-level (or inflation), target a money aggregate, or use the exchange rate as a nominal anchor. Researchers disagree as to the best approach for LICs, and there is only limited consideration of the choice for conflict-affected countries specifically. Ultimately, the right approach will partly depend on institutional capacity and history (e.g. Somalia did not have a functioning central bank during its 20-year civil war, whereas Gambia has a longer institutional history).

For LICs, proponents of targeting money aggregates argue that inflation-targeting only delivers lower inflation volatility and lower output volatility than money-rules when demand shocks dominate. Since supply shocks tend to be more common in LICs (and many conflict-affected countries), and because inflation-targeting responses increase output volatility in those contexts, a money-target is preferable. On the other hand, proponents of inflation or price level targeting argue that money demand is unpredictable and more volatile in post-conflict contexts, making monetary policy reliant on money demand forecasts challenging.

Exchange rate anchors have been found to be effective at reducing inflation, particularly where administrative and institutional capacity is low, as it often is in fragile contexts. Monetary policy based on monetary aggregates and policy rates has limited effectiveness in contexts where the financial sector is underdeveloped and conflict often further thins financial markets. The trade-off of adopting a fixed exchange rate as the nominal anchor is the potential loss of monetary policy independence in the context of relatively open capital markets.

[1] International Monetary Fund. 2015. “Building Resilience in Sub-Saharan Africa’s Fragile States.”

Finding 3: There may be a role for aid to promote monetization and help control inflation in conflict-affected contexts.

Seigniorage is a relatively important source of revenue for many conflict-affected countries. There is some evidence that inflation rises during conflict and falls post-conflict but remains higher than the pre-conflict period, and that seigniorage follows a similar pattern.

Aid may have a decisive role to play in “monetary reconstruction” analogous to the traditional role of aid in rebuilding physical infrastructure post-conflict. Rebuilding the “financial buffer” post-conflict could be an important crisis response role for aid. Aid can be used to ‘reconstruct’ the demand for money and hence seigniorage capacity through three mechanisms: (1) aid substitutes for seigniorage revenue, enabling the government to reduce reliance on inflation and thereby stimulate recovery of demand for money; (2) aid restores money demand indirectly through its effect on income growth; and (3) aid plays a role in supporting a modest portfolio shift in favour of domestic money demand.

Monetary authorities may need to guard against aid-surges resulting in real-exchange rate appreciation to the detriment of export sectors. To the extent that aid is not used to buy imports, it may also be inflationary. The evidence suggests that positive post-conflict effects of aid on recovery would not be dependent on choice of the exchange rate regime.

Photo by Terry Boynton on Unsplash

Finding 4: The evidence appears to suggest that either a fixed or managed exchange rate regime may be preferable to a floating regime in fragile contexts affected by conflict.

Conflict-affected contexts are often characterized by a degradation of the country’s currency because of capital flight, inflation, financial system disruption, and movement into foreign currencies as more reliable stores of value. Undervaluation of the real exchange rate may be a powerful tool to bolster capital investment, attract flight capital back to the country, and encourage export-led growth. A consistent finding in the literature is of a robust correlation between the stability and level of the real exchange rate and growth, particularly for low income African economies. There is evidence that nominal exchange rate volatility is the primary source of real exchange rate volatility in these countries.

There are three broad policy choices for the nominal exchange rate regime: fixed exchange rate (including dollarization, currency boards, monetary union); managed exchange rate (e.g. crawling peg, managed float); and floating exchange rate. There may be a case for the active management of the nominal exchange rate to achieve a real exchange rate undervaluation to support export development in conflict-affected contexts. As a result, fixed or managed exchange rate regimes may be preferred in contexts where capital mobility is limited. The case for this conclusion is strengthened by evidence that fixed regimes may bolster the positive impact of aid on long-run growth through its interaction with real exchange rate undervaluation.

Free-floating exchange regimes may be particularly inappropriate in fragile contexts for several reasons: thin financial markets, potentially volatile financial flows, weak central banks. Meanwhile, fixed regimes (including Monetary Unions, e.g. West Africa Economic & Monetary Union, and the emerging West Africa Monetary Zone) do provide a measure of stability and support policy credibility, critical goals for fragile states. Guinea-Bissau was cited as an example where joining a monetary union did increase macroeconomic stability.

Evidence gaps and future research

One of the key messages that we explored in Part 1 of this Reflections series on macroeconomic policies in conflict-affected contexts related to the need for more context-specific evidence around how macroeconomic policy and fragility intersect in conflict-affected settings. Our review of the evidence around monetary and exchange rate policy and fragility, together with our conversations with experts, revealed the following areas that might benefit from further research or evidence gathering.

- The research to date has focused on low-income countries, particularly in sub-Saharan Africa, in part due to the concentration of civil wars in that region. Future work could expand the focus to include more emphasis on Asia, and the MENA. In addition, more attention could be paid to middle-income fragile and conflict-affected contexts.

- Where there is evidence from conflict-affected contexts specifically, it is usually focused on post-civil war settings. Future approaches could consider ways to gather evidence from a diverse range of fragile contexts and consider how to broaden perspectives on conflict prevention to include consideration of initial lapse into violent conflict.

- A narrower focus on conflict-affected contexts is required to develop a better evidence base to inform decisions regarding the range of appropriate inflation rates, and choice of nominal anchor for the prevention of conflict.

- Money demand in conflict-affected contexts has not been studied extensively. The key findings related to money demand are based largely on one study, although others have more recently highlighted the importance of this variable and the importance of the restoration of money demand in post-conflict settings.

- Further investigation of the interactions between real exchange rate undervaluation, export growth, and the exchange rate regime are needed, particularly in fragile contexts.

This is the final in a series of “Reflections” exploring the intersections between macroeconomic policy and fragility in countries affected by violent conflict.

Click to read the overview of the series “Macroeconomic Policies in Conflict-Affected Contexts”, the second in the series, “Natural Resource Revenue Management in Conflict-Affected Contexts,” and the third in the series, “Tax Policy and Fragility in Conflict-Affected Contexts”.

For more information, contact: info@deetken.com