This is the third in a series of four Deetken “Reflections” exploring the intersections between macroeconomic policy and fragility in countries affected by violent conflict. The first post in this “Reflections” series provided an overview of the key messages emerging from a review of over 100 sources and 10 expert interviews. The second explored the impact of natural resource revenue management on fragility in conflict-affected contexts. This post summarizes the evidence around how macroeconomic policies related to tax policy impact fragility in conflict-affected countries. We conclude with a number of evidence gaps that could form part of a future research agenda. This series builds on work that Deetken undertook on behalf of The World Bank and the United Nations.

There is a significant amount of literature on the linkages between taxation and development, and taxation and growth, and there is a growing body of work on taxation, governance, and state-building. However, only a limited number of resources focus explicitly on the relationship between taxation and fragility in conflict-affected contexts. Through a review of the literature and expert interviews, we explored this relationship with a view to identifying policy-relevant findings that could help guide tax policy, including tax reform efforts, in countries affected by conflict.

We explored four dimensions of taxation:

i) formal taxation;

ii) informal taxation;

iii) local taxation; and

iv) aid and taxation

Here are six main findings emerging from our review of the evidence and our discussions with experts.

Finding 1: Well-designed tax policy can contribute to state-building, improved governance, peacebuilding, and political and economic stability, but conflict-affected contexts face a unique set of challenges with respect to tax reform.

Well-designed tax policy can contribute to state-building, improved governance, peacebuilding, and political and economic stability through six mechanisms. These include:

- generating adequate, appropriate, sustainable and predictable revenue;

- enhancing the legitimacy of the state and signalling the population’s “buy in” with respect to the government’s agenda;

- improving state-society relations;

- building capacities;

- extending state authority; and

- addressing horizontal inequalities.

Conflict-affected contexts face a unique set of challenges with respect to tax reform. These can include: a real or perceived lack of legitimacy; a lack of trust and confidence in the state and/or other groups in society; a lack of political consensus and/or historical precedent around who should be taxed and how; weak technical, technological and statistical capacities; large informal and agricultural sectors; a contracted tax base; relatively low revenue; and a poor record of redistribution through the tax system.

Finding 2: When it comes to formal sector taxation, policy-makers in conflict-affected contexts need to understand and work within the political economy of tax reform, which may require generating a better understanding of the dynamics behind “tax bargaining.”

Only a limited body of literature addresses questions related to the impact of tax policy and tax reform on fragility. When these questions are addressed, they tend to be considered through one of two lenses: taxation and inequality, and taxation and democratization.

Much of the literature that considers the linkages between equality and tax reform focuses on progressive taxes (as opposed to regressive or proportional taxes). This applies to both direct (e.g. income, profits, capital gain and property taxes) and indirect (e.g. raising rates on luxury goods and exempting basic goods that are generally consumed by the poor) taxes.

However, there is no consensus on the relationship between progressive taxation, growth and inequality. Several sources stress that the impact of taxation on growth and/or equality will depend on how tax revenue is spent, that is, whether it is spent on promoting growth and/or on efforts to reduce inequality. Yet, it is rare for tax and spending to be considered in the same study. This may be primarily due to a lack of data, including revenue data, and to the fact that it is difficult to determine the distribution of tax burdens and gains from redistribution. Some other sources suggest that progressive taxes can have a negative impact on growth, which can harm the poor. Others argue that the impact of taxation is largely dependent on the extent to which the tax regime permits legal avoidance and illegal evasion. Some work argues that progressive taxes can undermine the “elite bargain” and therefore risk compromising the conditions that made an end to conflict possible in the first place.

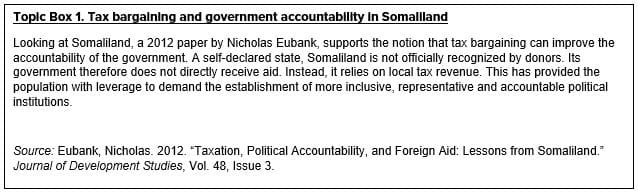

These discrepancies point to the need to understand and work within the political economy of tax reform, particularly at the nexus of taxation and conflict. In this regard, it may be useful to develop a better understanding of the dynamics behind “tax bargaining” (i.e. the connections between taxation, responsiveness and accountability) in specific conflict-affected contexts.

Finding 3: While there are options for taxing the informal sector, formalization can bring additional benefits that may have an impact on reducing fragility in conflict-affected contexts.

Taxation of the informal sector (which we define as firms and individuals who are not fully registered and regulated and, for this reason, fall outside the standard tax net) is difficult and may not be cost effective. The positive impacts of taxation of the informal sector are most effectively achieved through formalization, i.e. bringing firms and individuals into the tax net. While this is unlikely to generate significant revenue, the benefits of formalization can include: greater business growth, the establishment of a better business environment, building a culture of tax compliance and strengthening the fiscal social contract, all of which can contribute to reducing fragility. However, a firm or individual’s decision about whether or not to formalize depends on a calculation of costs (e.g. higher taxes) versus benefits (e.g. business growth opportunities).

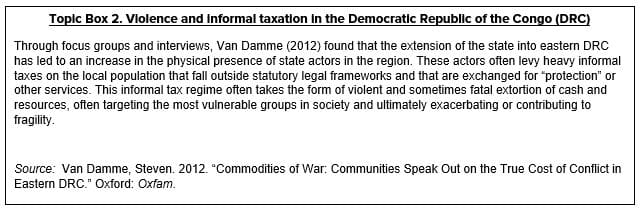

Finding 4: Insights into the informal taxes individuals and households may face may reveal and ultimately help to mitigate predatory behaviour on the part of state actors, thereby improving state-society relations.

The impact of informal taxes, including tax or tax-like payments collected outside of statutory legal frameworks, on individuals and households has not received sufficient policy attention. This is an “analytical blind spot.” Informal taxes can be especially prevalent in conflict-affected contexts and can expose people, particularly vulnerable groups, to violence.

Finding 5: Integrating local taxation into the consideration of the broader tax bundle to which individuals and households are subjected may generate important insights into the tax reforms necessary to reduce fragility in conflict-affected contexts.

Until recently, limited policy and research attention has been paid to local taxation (i.e. taxes assessed and levied by local authorities with revenues spent locally). Recent work suggests that local taxation can help improve state-society relations by increasing ties between public authorities and the population, including through tax bargaining, and enhancing the legitimacy of the state.

However, there is insufficient evidence to back up the theoretical literature on the impact of local taxation on revenue generation, statebuilding, governance, and reducing fragility. At least one group of researchers has considered the impact of local taxation on individuals and households and argued that, to understand the impact of local taxes on fragility, there is a need to better understand the broader tax package to which people are subjected. A focus on the realities of how people are actually taxed may generate important insights into the tax reforms necessary to reduce fragility in conflict-affected situations.

Finding 6: The impact that aid has on the domestic tax effort in conflict-affected contexts will depend largely on the existence of non-tax revenue sources (e.g. natural resources) as well as on the broader political and economic dynamics within a recipient country.

The question of whether aid undermines the domestic tax effort has been rigorously researched in recent work. There is no consistent evidence that aid definitively undermines the domestic tax effort. The literature suggests that while aid may in some cases reduce incentives for tax collection, in others it may contribute to effective taxation by:

- providing technical assistance that improves the efficiency and effectiveness of the taxation system;

- reducing the trade-offs inherent in the tax regime and buying time for political actors to build capacities to take over responsibility for the peacebuilding agenda; and/or

- making visible improvements in the delivery of public goods, thereby motivating the population to pay taxes.

The impact that aid has on the domestic tax effort will depend largely on the existence of non-tax revenue sources (e.g. natural resources) as well as on the broader political and economic dynamics within recipient countries, including the country’s tax culture, how tax bargaining works, and the influence of external actors, among other contextual considerations.

Evidence gaps and future research

One of the key messages that we explored in Part 1 of this Reflections series on macroeconomic policies in conflict-affected contexts related to the need for more context-specific evidence exploring how macroeconomic policy and fragility intersect in conflict-affected settings. Our review of the evidence around tax policy and fragility, together with our conversations with experts, revealed the following areas that might benefit from further research or evidence gathering.

- There is a paucity of comparative, policy-relevant research on the political economy of tax policy in conflict-affected contexts. This includes research that focuses on the impact of taxation on conflict dynamics and the particular challenges of tax collection in post-conflict contexts.

- Beyond general principles (e.g. broaden income tax and introduce a VAT), there also appears to be a dearth of research on the different types of taxes or options related to the composition of the tax regime that have proven to be the most effective in both generating revenue and reducing fragility in conflict-affected contexts.

- Empirical research exploring the dynamics behind “tax bargaining” (i.e. the connections between this taxation, responsiveness and accountability) has been limited and fragmented. A larger study of conflict-affected contexts might facilitate a closer look at the legitimacy dimensions of taxation (not only its impact on revenue generation), and allow for a deeper consideration of how taxation fits within the “fiscal social contract,” how it impacts perceptions of state legitimacy and the population’s trust and confidence in the state, and the influence of external actors, among other considerations. This type of research may require a more ethnographic, rather than a strictly econometric, approach in order to understand the “social impact” of tax. It might be a useful starting point for considering how and when tax reform might be most effective, particularly in conflict-affected contexts.

- There is a dearth of research exploring informal and local taxation regimes in conflict-affected situations, particularly their impacts on reducing or contributing to fragility in these contexts. Micro-unit analysis may yield useful insights into the broader tax regime faced by individuals and households. A focus on the realities of how people are taxed may also help policy-makers identify areas or sectors where tax reform might be most likely to reduce fragility in conflict-affected situations.

- It might be useful to expand work related to the impact of aid flows on the domestic tax effort to consider the relationship between aid and taxation under the unique conditions facing countries affected by conflict. Specifically, it may be helpful to develop case study evidence around the economic, social, political and historical circumstances under which aid tends to discourage (or encourage) the tax effort in conflict-affected contexts. This research would have to be carefully designed and would have to account for the severity of conflict and the capacities of the central government, including its ability to extend its authority beyond the capital, among other considerations.

This is one of four news articles that study the impact of monetary and exchange rate policy on fragility in conflict-affected contexts. Click to read the overview of the series “Macroeconomic Policies in Conflict-Affected Contexts”, the second in the series, “Natural Resource Revenue Management in Conflict-Affected Contexts,” and the final in the series, “Monetary and Exchange Rate Policy in Conflict-Affected Contexts”.

For more information, contact: info@deetken.com